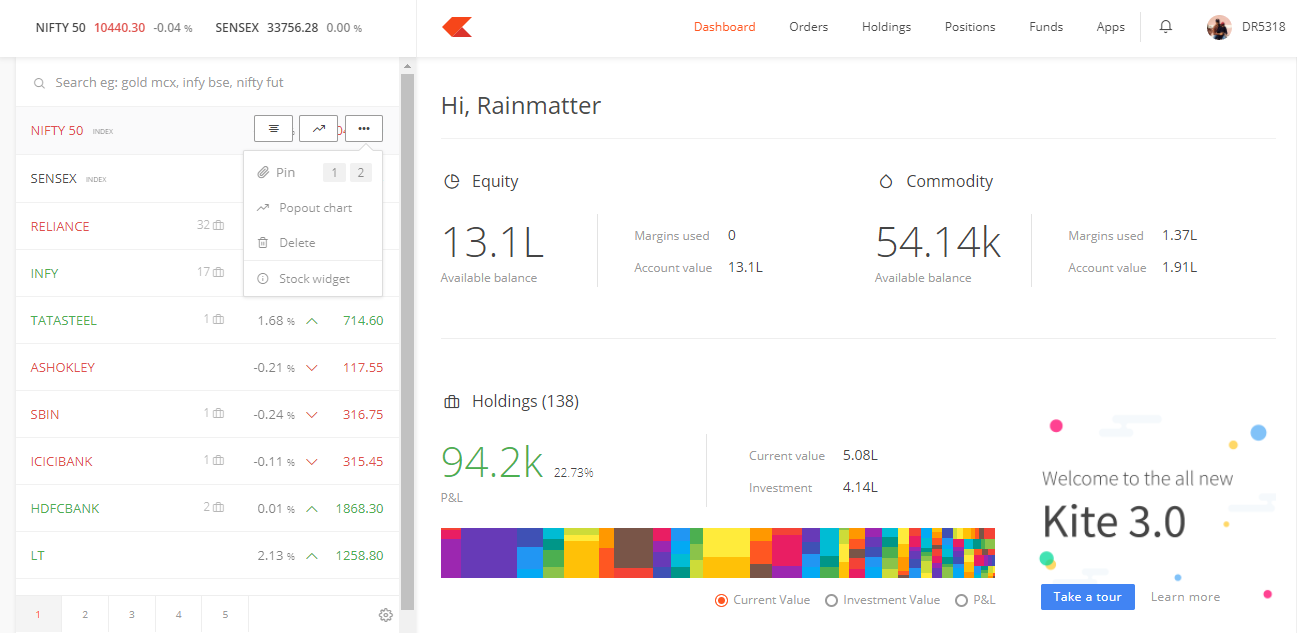

Sensex Vs Nifty Returns : Investing Myths India Edition Stock Market Returns Symantaka - Nifty stands for national stock exchange fifty and is the equity benchmark index of the national stock exchange (nse).

Sensex Vs Nifty Returns : Investing Myths India Edition Stock Market Returns Symantaka - Nifty stands for national stock exchange fifty and is the equity benchmark index of the national stock exchange (nse).. Sensex zooms over 1,700 points; Route mobile management on q3 earnings & more january 29 2021, 7:02am; To see this from another perspective, have a look at the table below. Sensex, nifty end lower for fifth day; In the 4 calendar years (current included) nifty 50 tri has given negative returns (2008, 2011, 2015 and 2020 ytd), both the low volatility indices have beaten the nifty massively.

Why should you not invest in nifty or sensex index fund? There are so many factors that could influence the movement of stocks and in turn the index. We will just use the average historical returns of equities as an asset class and an assumption of broader market returns reverting back to these averages (currently we are lower than the average). One of the most critical points of difference between sensex and nifty is the number of stocks each index comprises. Over the last ten years, the nifty 50 has generated a compounded annualized growth rate (cagr) of about 6.01 per cent (as on march 16, 2020), an absolute return of about 79 per cent, while the bse.

The sensex ended 5 points higher at 47,751 and nifty 50 index closed unchanged.

Why should you not invest in nifty or sensex index fund? Sensex, nifty end lower for fifth day; The movement of sensex/nifty is in accordance with the movement of stocks present in the index. The index tracks the behavior of a portfolio of blue chip companies, the largest and most liquid indian. The nifty 50 is the flagship index on the national stock exchange of india ltd. Why we must consider tri to calculate actual returns. Sensex is india`s oldest index launched in 1986 while nifty 50 was launched after 10 years. One of the most critical points of difference between sensex and nifty is the number of stocks each index comprises. For example, when there is an election result or when there is an escalation of trade war or when there is an announcement of a rate cut, sensex and nifty. Sensex & nifty are considered to be almost same as most of these indexes are mirror image to the indian equities where sensex is the index of the bombay stock exchange (bse) and nifty 50 is the index of the national stock exchange (nse). In my opinion, the lower drawdown is the primary reason why the nifty 100 low volatility 30 and nifty low volatility 50 have beaten nifty 50 on all the parameters. 72,222 points on 21 jan 2021 vs 4,356 points on 30 jun 1999. The sensex ended 5 points higher at 47,751 and nifty 50 index closed unchanged.

Since inception portfolio vs sensex. In oct 2020, ril occupies about 15% of the nifty and about 17% of the sensex. That is, choose an index and make the same transactions as you have done in your portfolio with it. So below is the nifty historical chart showing annual nifty returns since 1996 (i.e. Now with the entire complexion of the economy changing,.

In oct 2020, ril occupies about 15% of the nifty and about 17% of the sensex.

Do not go just by what the actual nifty and sensex returns have been. In the 4 calendar years (current included) nifty 50 tri has given negative returns (2008, 2011, 2015 and 2020 ytd), both the low volatility indices have beaten the nifty massively. Sensex zooms over 1,700 points; Sensex vs nifty tri movement since 30 june 1999 Mutual funds, brokers and portfolio managers prefer to track nifty as it is more diversified and has a vibrant derivative market. The index tracks the behavior of a portfolio of blue chip companies, the largest and most liquid indian. Sensex & nifty are considered to be almost same as most of these indexes are mirror image to the indian equities where sensex is the index of the bombay stock exchange (bse) and nifty 50 is the index of the national stock exchange (nse). The chart below shows the kind of returns gold and nifty have been generating since 2006 till date. 72,222 points on 21 jan 2021 vs 4,356 points on 30 jun 1999. Over the last ten years, the nifty 50 has generated a compounded annualized growth rate (cagr) of about 6.01 per cent (as on march 16, 2020), an absolute return of about 79 per cent, while the bse. Why we must consider tri to calculate actual returns. However, if you look at the growth rate, the sensex has a cagr of 14.1%, while nifty has a cagr of 13.89%. Since the sensex has the top 30 companies while the nifty has the top 50, the sensex does have that small advantage.

However, s&p cnx nifty is still commonly known as nifty or nse nifty. There are only 3 occasions (2008, 2010 and 2011) when gold has beaten nifty returns on a yearly basis. Sensex zooms over 1,700 points; If we look at the total returns index price movement from june 1999, there is not much difference between the two. The movement of sensex/nifty is in accordance with the movement of stocks present in the index.

Now with the entire complexion of the economy changing,.

Nifty bank outperforms january 28 2021, 11. That is, choose an index and make the same transactions as you have done in your portfolio with it. Since the sensex has the top 30 companies while the nifty has the top 50, the sensex does have that small advantage. The nifty 50 is the flagship index on the national stock exchange of india ltd. There are only 3 occasions (2008, 2010 and 2011) when gold has beaten nifty returns on a yearly basis. Sensex, nifty end lower for fifth day; Sensex is india`s oldest index launched in 1986 while nifty 50 was launched after 10 years. The movement of sensex/nifty is in accordance with the movement of stocks present in the index. Mutual funds, brokers and portfolio managers prefer to track nifty as it is more diversified and has a vibrant derivative market. In the 4 calendar years (current included) nifty 50 tri has given negative returns (2008, 2011, 2015 and 2020 ytd), both the low volatility indices have beaten the nifty massively. Gold delivered negative returns in three out of the last ten. Another is that sensex is comprised of 30 stocks, while nifty is comprised of 50 stocks. Nifty is the indicator of top companies heavily traded on nse while the sensex is the indicator of top companies heavily traded on bse.

Komentar

Posting Komentar